CorrelScan Help

Introduction

CorrelScan is a general purpose correlation tool that

helps you compare all items in a list to all the others.

Most technical analysis programs that allow you to run such correlation scans, for example TCScan+, allow you to see how one

item compares to other items in a list. This is useful when you have a

particular item you are interested in, but if you are instead looking for good

trades within a basket of items, for example in pairs trading, then you need a tool

like CorrelScan.

The

primary statistical measure of how similar (correlated) two items are, is the

Correlation Coefficient. It can only have values from -1 to +1.

Values close to +1 indicate that the items behave very similarly, while values

close to -1 means they behave in an opposite manner. Values close to 0

indicate that the two items are not related at all. Examples are provided

below.

There

are a number of ways you can use CorrelScan:

|

You can trade sets of similar

stocks off each other. If one stock starts a move, for example

after some good news, you can trade closely-correlated stocks to

it, knowing they will move in a similar way soon thereafter. If you played

the primary stock directly you might only catch the

tail-end of the move, whereas by buying its correlated

partners you could catch a much larger part of the

move. You would also lessen your risk by being more diversified. The chart below shows an example where two items are well

correlated up to the time of the scan (indicated by the vertical dotted

line) and then proceed to move the same after the scan date.

Notice that the two items do not move perfectly in sync either before or

after the scan date, but they generally follow the same direction - you

will always need to allow some margin of error in these types of trades. |

|

You can trade dissimilar stocks

off each other. If one starts trending up you can

short another that is anti-correlated to it knowing that there is a good

chance you will be right. The

chart below illustrates an example - note the continued dissimilarity

after the scan date. |

|

You can balance your portfolio,

making sure that you have a diverse set of items that will not be affected by each other. In this

case you select items that are not

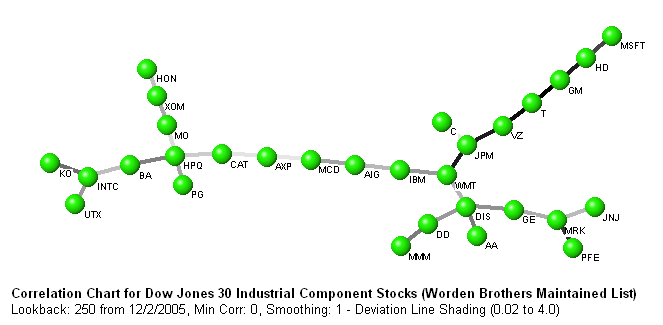

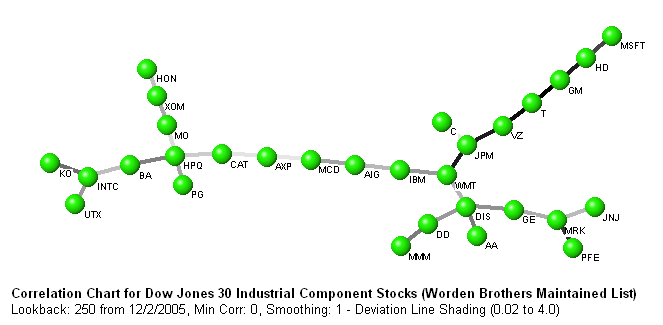

well-correlated with each other. The linkage chart below shows the

components of the Dow Jones Industrials list, with the most similar

items connected by lines. As described in more detail later, a

balanced portfolio should consist of items selected from the outer edges

of the chart, for example KO, HON, MSFT, JNJ and MMM in this example. |

|

You can find items that normally behave very similarly, but are

currently not doing so. You can then take trades betting they

will soon revert to normal behavior - this is known as

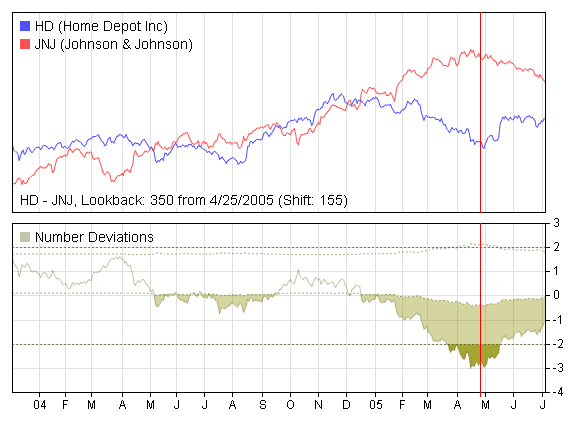

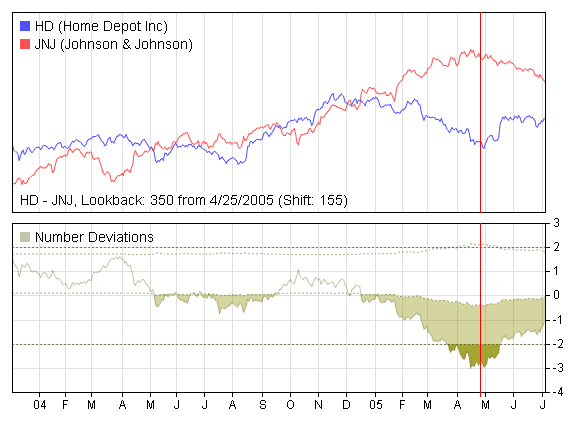

Pairs Trading (or more completely 'Risk Arbitrage Pairs Trading'.) An example chart is shown below. In the top

pane is shown the price data of the two items and in the bottom pane is

shown the relative price difference between the items (in terms of

multiples of the average difference between them.) You can see that the

items move more or less in sync until around February 2005, when they

start to diverge more than 'normal'. The scan date, indicated by

the vertical red line, is around May 2005 and this pair was highlighted

because the difference between the items was almost 3 times the normal

difference and the difference was starting to flatten out. This

behavior, for

normally well-correlated pairs, is an indicator that they may soon start

to revert to normal behavior. You can see that the items indeed

did turn around, so if you had shorted JNJ and bought HD (or their

options) you would have made a good profit. |

|

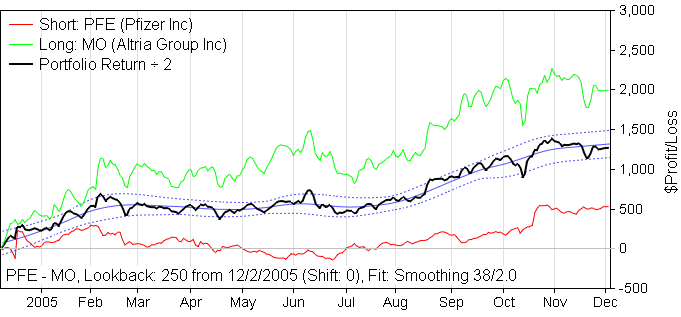

You can find minimum volatility pairs, i.e., pairs where you take a long

position in one of the items and a short position in another so as to

reduce the volatility of your position. CorrelScan helps you to

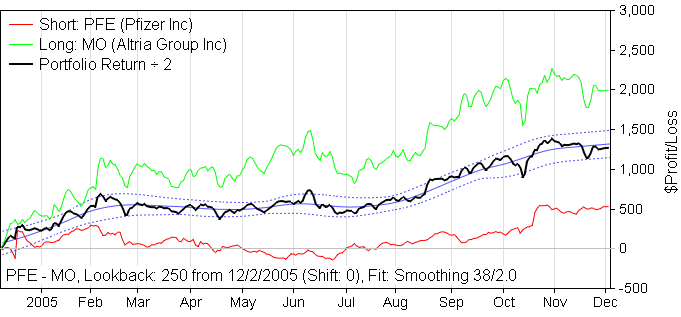

balance the risk versus the return for the pair. The chart below

shows an example, where PFE was sold and MO was purchased. The

green and red curves show the trade profit for each item and the black

curve shows the average profit for the pair. You can see that if

you had just purchased MO, you would have made $4,000 profit, but would

have had to endure almost $1,500 changes in profit along the way.

On the other hand if you had just shorted PFE, you would only have made

$1,000 profit and had to endure $500 changes in profit along the way.

On the other hand, the combined pair would have made you $2,500 profit,

but more importantly, you would only have had to endure a maximum of

around $500 profit change along the way, with a much lower average

change than that. So you do not make as much as you could have -

but you sleep a lot more peacefully! |

Program Operation

|

In

simple terms, follow these steps to run CorrelScan:

-

Select one or more lists from TeleChart to scan

-

Specify general program settings such as how many bars of data to include,

how far back to start the scan, whether to smooth the data, etc.

-

Specify list-filtering criteria to narrow down the items in the lists.

You can filter items based on price, range of movement, volume, exchange

type and optionability. This helps reduce the number of items in your

scan, which helps shorten execution time.

-

Specify whether a summary chart should be generated at the end of the scan

and provide settings for it. This chart is very useful for getting an

overview of how the items in your lists are related, but it can take a long

time to generate for large lists, so for these it may be best to disable its

generation and just use the output data table.

-

Run

the scan.

-

Review the summary chart (if it was generated) and/or review the data output

from the program. In both instances you are able to retrieve charts

and data for any of the pairs in your list (as shown in the introductory

examples above.) The data table allows you to sort and filter the

output by numerous criteria allowing you to find the potential trades you

want.

-

Save

and/or print the charts and/or data for later use.

These

steps are described in more detail below.

|

|

Program Settings

When first started, the main CorrelScan form will

appear similar to that shown below.

Each of the sections on this form are described below.

List Selection

At the top of the form you will see the list selection box.

All the lists contained in your version of TeleChart are there, including ones you have created yourself.

Be aware that

because CorrelScan compares every item in the list to every other item, the time

a scan takes is related to the square of the number of items. So for

example, a list with 70 items will take almost twice as long to scan as a list

with 50 items in it. This is not a prohibitive issue, because some users

regularly scan lists with 1,000 items or more in them, but when you are starting

out, we suggest you stick to smaller lists.

Settings

The

various general settings are as follows:

|

Lookback

Period The number of days for which you want to correlate the

stocks against each other. Shorter periods will find short-term

trends and longer periods will find longer ones. We do not recommend

using periods below about 100 days, because such short correlation periods

are not likely to have continued relevance in the future. On the

other hand, the longer the lookback period, the longer it will take to

run the scan so you need to balance this setting. |

|

Shift

The number of days back to start the scan. A value of '0' means

the scan will start with the most recent data. Increasing it allows you to

run scans for the past so you can evaluate how correlations at a certain point in time affected future

behavior. This helps you fine tune your settings so they suit your

requirements. |

|

Maximum Offset is the maximum

amount of offset to be allowed in the search for the

best correlation. To clarify, consider two stocks 'A' and 'B' that

you are trying to correlate. CorrelScan will first work out the

correlation between 'A' and 'B' and will then shift 'A' both backwards and

forwards in time compared to 'B', one day at a time, until the maximum

number of days you specify in 'Max Offset'. At each point CorrelScan

will work out the new correlation, keeping track of the best one.

This best correlation is the one reported by CorrelScan, along with the

number of days of offset between the items when this correlation

occurred. This option is very useful, because changes in 'A' might lead

to changes in 'B' some days later, or vise versa. Knowing the best

correlation and offset period between 'A' and 'B' will allow you to

predict changes in 'B' based on earlier behavior in 'A'. The optimum

offset is included in the output data and if you choose to display the

linkage chart, it will also be displayed on the caption bar when you

move your cursor over the chart. If the offset

is shown as positive, then the base security

predicts the linked security, and if the offset is shown as negative

then the linked security predicts the base. |

|

Ret Corr for Offset defines the method that will be used to find the

best offset between correlated items when you have a number entered for

the Maximum Offset. When this box is unchecked CorrelScan will

correlate the price of the two items in question. When it is

checked, the daily price change will instead be used. The former

favors longer-term/overall similarity, while the latter favors daily

responsiveness of one item to the other. You can ignore this

setting if you are not allowing the offset to be adjusted (which you

should do when starting out.) |

|

Correlation - Std Dev Offset This setting is used mostly

for Pairs Trading, when you are looking for items that are normally

correlated but are currently not so, so you can trade them as they

revert to normal. CorrelScan works out the correlation for each

item as well as how far from normal the items currently are. The

problem, however, is that if the items have been away from normal for a

while, the correlation coefficient will be affected, because it will be

indicating to some extent the current disimilarity between the items

rather than how similar they normally are. Therefore it is useful

to only determine the correlation coefficient up to a certain point in

the past and remove any current divergence from the picture. The

number you enter in this setting dictates how many bars back the

correlation will stop. So, for example, if you enter '25' here and

your lookback period is 250, then the correlation will only be detemined

for the 225 days starting 25 days back. The most recent 25 days

will not be included in the correlation calculation. |

|

Smoothing Period The value entered here will be used as the period for a simple moving

average of the data, which will then be used in place of the original data for the

correlation calculations. A smoothing period of 1 indicates the data

will be used unsmoothed. |

|

Use Close Prices CorrelScan normally uses the average of the

open, high, low and close of each day for its calculations. If you

check this box it will only use the close price. |

|

Deviation Slope Period This setting is also used

mostly for Pairs Trading. When CorrelScan calculates the deviation

between items, i.e., how different they currently are from normal, it

also works out the slope of the deviation. This helps you know

whether the difference between the items is increasing or decreasing.

The number entered in this setting is how much of the data to use to

work out the slope. For example a value of '10' means the last 10 days

will be used to work out the angle of the deviation. Higher

numbers are better for longer term positions and lower ones for shorter. |

|

Price Change/Trend Period

is the time period over which CorrelScan should check whether the stocks

are trending or changing in price, for trend coloring (see above.)

|

|

Detrend

Period

This setting allows you to remove the trend from the data, which is

sometimes useful to discover the underlying behavior between items.

We recommend, however that you leave it at 0 until you are more familiar

with the program. The number entered in this setting is used to

create a moving average of the data, which is then subtracted from the

data. This is a standard way to remove the trend from the data.

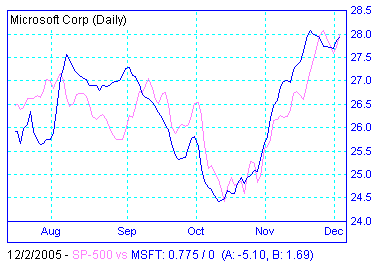

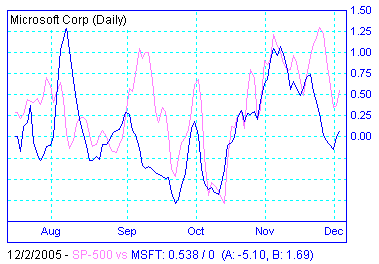

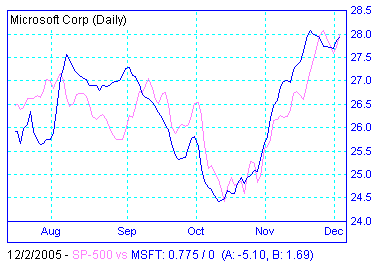

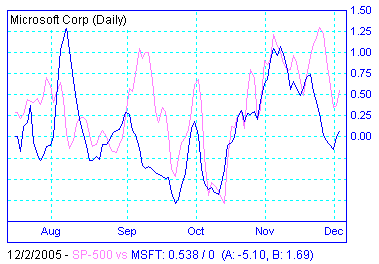

Shown below is a chart of MSFT compared with the SP-500 index, both with

and without 10 bar detrending. You can see in the latter chart

that the price action is flattened, emphasizing the relative movement of

the two items. |

|

Log Returns

In a number of calculations, CorrelScan needs to determine the daily

change in price. This is also know as the return. This

return can either be calculated arithmetically, where the return is just

the price difference between the current day and the day before that

divided by the previous day's price. It can also be calculated

logarithmically, if you check the Log Returns box, in which case the

return will be calculated by the logarithm of the ratio between the

current and previous day's prices. The latter option is more

commonly used, especially in academic circles, though the results tend

to be fairly similar. |

|

Returns Trend Fit / Smooth / Fit Length This setting is used when

finding minimum volatility pairs, that is, when you are trying to find

two items where you will go long one and short the other and you want

the overall volatility or risk of the position to be minimized.

This setting can be better understood after reading about this kind of

trade above, but in principle the daily return of the combined long and

short positions is plotted versus time and a curve is fitted to a

portion of the end of the returns curve to help calculate relevant

information about it. For example, it is important to know whether

the combined returns curve is increasing or decreasing, because that

indicates whether you would be winning or losing money in the position.

The type of curve fitted can either be a polynomial or smoothed.

If you choose the former you can specify the order of the polynomial - a

polynomial of order 1 is a straight line, order 2 is a parabola, etc.

If you choose the latter, you can specify the smoothness of the curve.

The 'Fit Length' specifies how many bars are used to calculate the

curve. |

List Filtering

Checking the List Filtering box will allow you to filter items in the selected lists by

price, volume, exchange and optionability. This is useful to reduce the

number of items in the list and speed up your scans.

|

Closing Price allows you to select the range

of closing prices for items in your scan. |

|

Price

Range allows you to select how much price movement the items in your

scan must

have had over the lookback period. CorrelScan searches all the data over

the lookback period, finds the highest and lowest prices and determines

the difference. This result must fall within the two numbers you enter.

Setting the range allows you to keep out very volatile or very range-bound

items. To ignore the price range, set the limits very wide, for example

from 0 to 100000. |

|

Average

Volume allows you to select the average daily volume for your filtered

items. The value you enter is multiplied by 1,000 to get the actual

volume. Note that this is different from the TeleChart convention, which is

to show volumes divided by 100. |

Linkage Chart

Checking the Linkage Chart box will cause a chart to be generated at the end of

the scan. Other charts are available via the data grid and also via this

chart, but this one provides a good visual indicator of how items are correlated

with each other. The chart takes a long time to draw for large lists so

for these it would be better to not enable it and rather just use the data grid.

The linkage chart indicates correlation by drawing circles representing

each item, then draws lines linking the best correlated items together. It

allows you to quickly see which items are most like each other, and also those

which are least alike. An example is shown below for the Dow Jones Industrial

Components. You can quickly see that INTC and HWP are closely correlated for the

period of this scan, while SBC and KO are not. Full details and

settings for the linkage chart are described elsewhere

in this help file.

Data Options

This

section allows you to specify settings for the data table generated by the scan.

You can choose whether or not to swap the pairs in the table so the item to be

shorted is always in the first column and the long is in the second column.

You furthermore can choose whether to swap the pairs based on whether you are

trying to find minimum volatility pairs (Risk Adjusted Return option) or

long-short pairs trading opportunities (Number Stds Difference option.)

Note: the current beta version only allows the Risk Adjusted Return option - the

final version will allow all three.

The Data

Options section also allows you to specify whether you want to include reference

statistics for items in your list. If the Include Reference Alpha &

Beta option is checked, then CorrelScan will include

Alpha and Beta values for each item versus a

reference you specify.

Running

the Scan

After you have specified the above settings, press the

button marked Scan at the bottom of the main form to start the scan.

While the scan is running, the other buttons and settings boxes will be

disabled.

Before starting the actual correlation of items,

CorrelScan will first check if all the items in the list have sufficient data to

match the criteria you have specified. If not, it will ask if you either

want to delete the items that don't have enough data or change your settings.

After that the scan will run and progress will be shown on the status bar at the

bottom of the form. Since CorrelScan correlates all items in the list

against each other, you will see two progress bars - the first showing the

reference item at the time and the second the item it is being correlated

against. The scan will appear to speed up as it progresses, because an

item is not scanned again once it has been a reference (the correlation of A to

B is the same as for B to A.)

If at

any time you want to stop the scan, press the Scan button again, whose

caption will have been changed to Stop while the scan is running.

If you

have selected to show the linkage chart when the

scan is done, it will be generated automatically. While the chart is open,

the scan button will continue to be labeled Stop and the other buttons on

the main form will be disabled. Pressing the Stop button or closing

the linkage chart will allow access to the main form again, which will allow you

to review the data grid and access other functions. You can then save the current settings, data files and chart generation

data by clicking the Save button on the main form. This allows you

to

reload this data in the future by clicking the Load button. When

the data is reloaded all the data files created by the saved scan are copied

into your main CorrelScan directory, replacing those already there.

Likewise the chart data replaces that of your current scan, so you only need to

press the Chart button to view the chart, not rerun the whole scan.

Reviewing

Data

Once the

scan is complete and you have closed the linkage chart (if generated) you can

press the Data button to access the data grid. The first form you

see will allow you specify whether you want to view all the data or a subset of

it. You can also load another file that you may have saved previously.

For small lists you can just view all the data, but for very large lists (around

250 items or more) it is better to only view a subset of it. The full data

set is always called 'Correls.csv' and the subset is called 'Correls_Filtered.csv'.

Both are in your CorrelScan directory.

Data Filtering

The

subset file is created using a predefined set of filters to reduce the size of

the file. If you have not defined this previously or would like to change

the filtering criteria, then press the button marked PreFilter on the

bottom of the above form - this will open the Data Filter form.

When

first opened, the form will only have one item you can filter by: Correlation.

To choose other items to filter by, press the button 'Change Criteria' at the

bottom of the form. This will allow you to specify up to a total of six

items whose range you can specify to filter out items you are not interested in.

To explain how the form functions, consider the portion of the above form for

the Correlation section:

At the

top left you see the name of the variable being filtered, in this case

'Correlation'. The blue bar in the center of the form allows you to move

the bounds of the filter range by clicking and dragging the edges with your

mouse. You can also set the ranges by entering numbers in the boxes (next

to 'Included:' above.) Checking the Include or Exclude buttons specifies

whether items inside or outside the select range will be included. As an

example see the form below with the left and right edges moved. You will

see that with the bounds where they are now, only items with correlations

between -0.41 and 0.73 will be included. The bold '69%' in the center of

the form means that only 69% of the data will be included, based on this filter.

You can also see from the numbers at the bottom left (-0.89) and right (0.94)

what the actual limits of the data are.

As

another example, shown below is the exact same form, but now with the Exclude

button checked. Here you see that all items with correlations between

-0.41 and 0.72 will be excluded. The '69%' does not change, but now

indicates what portion of data is excluded by this filter. The complete

count of items included by all the filters is updated at the bottom of the main

form.

Pressing

the Include All box will allow you to quickly remove the limits of this

variable in the filter. When the Symmetrical box is checked, the

left and right margins will be moved in equal amounts when the other margin is

moved.

As you

move the margins you will see the resulting number of rows displayed at the

bottom of the form. When you are satisfied with the reduced data set, you

must press the Create File button at the bottom right of the main form.

The settings that you have specified when you create this file will be used to

automatically filter your data the next time you run a scan, so you do not need

to go through this process every time unless you want to change the filtering

criteria.

Data Grid

*** PLEASE NOTE: THIS

SECTION TO BE AMPLIFIED AND ELABORATED IN FINAL VERSION ***

Once you

have selected the data source and performed any prefiltering, the Data Grid will

be opened up.

The data

grid lists all variables generated by CorrelScan. You can choose which you

want to view, depending on what you are interested in, via the Options >

Hide/Unhide Columns menu. Likewise, you can choose which rows to

exclude (filter) by using the Filter menu. Clicking the heading of

a column will sort by that column and you can access sorts by multiple columns

via the Sort menu. The Delete menu acts differently from the

Filter menu. When you filter the data, it is just hidden from view,

and can be returned to view by changing your filter criteria (or selecting

Filter > Remove Filter.) When data is deleted, however, it is

removed from the data set and can not be returned unless you reload the data

again (which you can do via the File > Open menu or by closing the

form and reopening it again.) If you save the data (File > Save)

to the same file you loaded, you will not be able to retrieve the deleted data

except by running the scan again.

From the

Delete menu you can permanently remove items that are current filtered (Delete

> Filtered Items), delete all other rows (pairs) containing Item 1 or

Item 2 of the currently selected row or both. The Prune Pairs option uses

a combination of the preceding. It allows you to create a list where only

the top pairs are shown. For example, you can list all pairs that have the

highest correlation. It does this as follows: using your current sort

criteria, the pair at the top of the list will be selected. CorrelScan

will then delete all other pairs in the list containing either of the items in

this pair. It will then move to the next row and do the same, etc.

You will end up with a number of pairs equal to half the items in your list that

are ranked the highest according to your sort criteria and where no items are

repeated in any other rows.

To move

up and down the data grid, you can press the Space/Backspace keys or

click the selector bar at the far left of the columns. To select multiple

rows you can hold down the Shift key and click on the selector bar for

the first and last row of interest. Likewise, use the Ctrl key to

select non-contiguous rows. When items are selected you can flag them via

the right-click menu. Flagging works by increasing or decreasing the count

in the column headed Flag. From the right-click menu you can

increment, decrement or zero the flag. You can then use this column as

part of your sort or filter criteria.

When the

data grid is opened the pairs chart will be opened automatically and will be

changed as you navigate through the pairs. You can switch between

Deviation Mode and Non-Deviation mode via

the chart's Option menu.

A

summary of the variables and column names available in CorrelScan for the

various scan types is listed

below. (Further details, formulae and examples will be

included in the final version.)

Correlation

Scan

|

Flag |

A counter that you can

increment and decrement via the right-click menu and then use in your

sort and filter criteria |

|

Item 1 / 2 |

Name of 1st/2nd item in

pair |

|

Correlation |

The correlation

coefficient for the pair |

|

RetCorr |

The correlation

coefficient for the daily

returns of the pair, rather than the absolute price |

|

Offset |

The offset at which the

correlation (or returns correlation) is maximum. You can specify

the maximum offset to check on the main form under 'More Options' (This

feature not fully debugged in the current Beta) |

| RAR |

The Risk Adjusted Return

of the pair, defined as alpha

divided by the standard error. |

| Price 1 / 2 |

Current price of items 1 and 2 |

| Alpha, Beta, Std Err |

See a full description

here. |

| RefAlpha, RefBeta,

RefStdErr |

Alpha, Beta and Standard error of the

item versus the reference you specify on the

main form. |

| Item Industry/Sub

Industry |

The Industry (sector) and SubIndustry (subsector)

for item 1 and 2. These follow the Worden classification within

TeleChart |

| AbsCorr, AbsRetCorr, etc. |

These are absolute values of the

equivalent variables defined above. They are included to help in

sorting & filtering where you do not care about the sign of the

variable. |

When

running correlation offset calcs (i.e. seeing at what relative offset between two

items the correlation is highest), the following additional fields are

shown:

|

C_Offset |

Optimum offset between the two items -

if this number is at the maximum offset you specified then it is not

meaningful |

|

C_Corr |

Correlation value at the optimum offset |

|

C_RetCorr |

Returns correlation value at the optimum

offset |

|

C_dCorr |

Difference between the non-offset

(normal) and offset correlation values |

|

C_dRetCorr |

Difference between the non-offset

(normal) and offset returns correlation values |

|

R_Offset, R_Corr, R_RetCorr, R_dCorr,

R_dRetCorr |

These are equivalent to the above items,

but in this case the information is provided for the optimum offset

based on highest returns correlation rather than highest price

correlation |

Risk Arbitrage Pairs

Scan

In

addition to the above items, the ones in the table below are also shown for this scan type.

Many of these relate to the spread (i.e. difference in price) between the two

items in question, which is an indication of how the two items move in relation

to each other over time. The spread is the main line shown on the lower part of the

chart when you click on a pair in the data table. Note that this scan type

is not valid for items with low correlations (roughly less than 0.5), so it is

best to filter these out using the 'Prefilter' option when the data file is

opened. Note also that this scan type includes estimates of back-tested

profitability over the scan period. To calculate this, CorrelScan

estimates optimum upper and lower cut points for the spread curve. When

the spread curve passes down through the upper cut line or up through the lower

cut line a trade is entered by shorting one item and buying the other. When the spread curve crosses the opposite

cut line the trade is closed. Information on individual trades taken can

be seen by clicking the 'Trades' menu item on the chart. Also see the picture below for further

clarification of terms.

For more details on this scan type, refer to 'Pairs Trading: Quantitative

Methods and Analysis by Ganapathy Vidyamurthy'.

| Crosses |

The number of crosses that the spread

curve makes through the zero point, which is an indication of how

mean-reverting the spread curve is, i.e., how likely it is that the

spread curve will revert to equilibrium (and that the items in question

will oscillate around each other.) |

| DaysCrs |

Average number of days between crosses

(see above) |

| Stat1/Stat2 |

These will be explained in further

detail in the final program version - they are different measures of

Stationarity, i.e., how likely it is that the spread curve oscillates

regularly. The higher these statistics the higher the level of

stationarity / mean reversion / crosses. |

| Trds/Yr |

Number of trades per year |

| %Profit |

Total percentage profit for all trades

(Click the 'Trades' menu item on the chart to see info on individual

trades) |

| %MAE |

Maximum adverse excursion as a

percentage of dollars invested (for example if $1,000 is invested and

the furthest a trade goes against you before it closes is $250, then the

%MAE is 25%.) An example of how the trade can go against you is

shown in the above chart between July and August - the trade is entered

at the lower cut line at the start of July and then instead of the

spread curve proceeding directly to the upper cut line, it meanders

around and even goes significantly lower than the lower cut line,

causing a negative position, before finally heading to the upper cut

line around 10 August. |

| TrdDays |

Days spent in-Trade |

| %LossDays |

Percentage of days in trade that are

losing days |

| Slope / Intcpt |

Slope and intercept used for calculating

the spread curve: Spread = Item 2 Price - (Item 1 Price * Slope +

Intercept) |

| Cut_L / Cut_U |

The 'optimum' cut points for determining

the extremes of the spread curve - see introduction to this section |

| MAE_10%/2% |

To be described later |

Minimum Volatility Pairs

Scan

In

addition to the above items, the following are also shown for this scan type.

Many of these relate to the spread (i.e. difference in price) between the two

items in question, which is an indication of how the two

| Port RAR |

The minimum variance risk adjusted

return for the portfolio. This is the risk adjusted return for the

pair at the point on the return versus standard deviation chart where

standard deviation is a minimum (the minimum variance point.) |

| Port RTRN |

The return value at the minimum variance

point. |

| Port STD |

The return standard deviation at the

minimum variance point. |

| Trnd RAR, Trnd Slope,

Trnd Err |

A line or polynomial is fitted to the

latter portion of the average profit curve for the pair. The Trnd

RAR is the slope of the line (Trnd Slope) divided by the standard error

(Trnd Err.) |

| MeanPrice 1 / 2 |

The expected price of Items 1 and 2,

based on predictions from the normal difference between the two items.

These numbers only have relevance for normally well correlated (or

anticorrelated) pairs. |

| Pct Gain |

The potential percentage gain from

taking a short/long position in Item 1/Item 2. This is based on

these items returning to their MeanPrice and is only relevant for items

that are normally well correlated. |

| Dev Angle |

The slope of the relative difference

curve for the pair. When the Stds Diff is high, you can look for a

flattening slope to indicate that a retracement is imminent. |

| RetMean1/2 |

Average return for items 1 or 2 |

| RetStd1/2 |

Standard deviation of returns for items

1 or 2 |

FURTHER INFORMATION,

EXAMPLES AND METHODS TO BE INCLUDED IN FINAL VERSION